Financial Planning

Class-9-Mathematics-1-Chapter-6-Maharashtra Board

Notes

|

Topics to be learn :

|

Financial planning involves saving money for future needs after meeting present necessities, which is then used to make carefully considered investments for future provisions.

Financial planning is useful for making provisions for the predictable and unpredictable expenses that each of us has to meet in our life.

- Predictable expenses : Education of children, for their marriages, buying a house, buying a vehicle, old age requirements, etc.

- Unpredictable expenses : Natural disasters, medical expenses for family members, loss due to an accident, sudden death, etc.

Savings :

- Savings are essential for personal growth and safety. They can be stored in a bank or post office, making them useful for cashless transactions. We do not have to carry large amounts of cash or worry about losing it or getting it stolen.

- If the money saved is not invested properly, its value diminishes with time.

- If the amount invested is used for expanding a business, to start an industry or other such purposes, it contributes to the growth of the national production.

- If some part of the income is spent for a socially useful cause everyone benefits from it in the long run.

Investments :

- Investments are of many types. Investors often favour institutions like banks and postal departments for investing their money because it is safe there.

- There is a certain risk in investing money in shares, mutual funds, etc. That is because this money is invested in a business or industry and if that incurs a loss, the investor suffers the loss too. On the other hand, if it makes a profit, the money is safe and there is the opportunity to get a dividend too.

- An investor must take two important points into account when making an investment, namely the risk and the gain.

- It is possible to make big gains by taking greater risk. However it must be kept in mind that the greater risk can also lead to greater loss.

Example : Amita invested some part of 35000 rupees at 4% and the rest at 5% interest for one year. Altogether her gain was Rs. 1530. Find out the amounts she had invested at the two different rates. Write your answer in words.

Solution :

Invested ₹ x at 4% rate, Invested ₹ y at 5% rate

x + y = 35000 ∴ y = 35000 – x ….(i)

Interest = x + y = 1530

∴ 4x + 5y = 1530 × 100 = 153000 …..(ii)

Substituting y from eq. (i)

4x + 5(35000 − x) = 153000

4x + 175000 − 5x = 153000

∴ −x + 175000 = 153000

x = 175000 - 153000 = 22000

∴ y = 35000 – 22000 = 13000

Answer is : Amita invested ₹ 22,000 at the rate of 4% and ₹ 13,000 at the rate of 5%.

Levying of taxes or Taxation :

The government makes many plans for the development of the country. It requires large amounts of money for implementing these schemes. By charging different types

of taxes, the funds are generated for implementation of these schemes.

Utility of taxes

- Provision of infrastructure / basic amenities.

- Implementing various welfare schemes.

- Implementing schemes of development and research in various fields.

- Maintaining law and order.

- Giving aid to people affected by natural disasters.

- Defence of the country and its citizens, etc.

Types of taxes :

(i) Direct taxes : Taxes which are paid directly by the taxpayer are called direct taxes.

- Examples : Income tax, wealth tax, profession tax, customs duty, etc.

(ii) Indirect taxes : Taxes which are not paid directly by the taxpayer are called indirect taxes.

- Examples : Central sales tax, value added tax, service tax, excise duty, etc.

In this chapter, we shall consider only those taxes which are to be paid by individuals.

Income tax :

Some Income tax related terms :

- An assessee : Any person, liable to pay income tax according to the Income Tax Rules, is termed as an assessee.

- Financial year : The period of one year during which the taxable income has been earned is called a financial year. In our country, at present, the financial year is from 1st April to 31st March.

- Assessment year : The financial year immediately following a particular financial year is called the assessment year. The tax payable for the previous financial year is calculated during the current year. i.e. the assessment year.

- g. financial year 01-04-2017 to 31-03-2018; assessment year 2018-19.

- Permanent Account Number (PAN) : On applying for it, every tax payer gets a unique ten digit alpha-numeric number from the Income Tax Department (PAN). We are required to mention this number in many important documents and financial transactions.

Computation of Income Tax :

Income tax is levied on income. The different sources of income are as follows :

- Income from salary.

- Income from house/property.

- Income from business or profession

- Income from Capital gain

- Income from other sources.

Important considerations for computing income tax :

- The total annual income (Gross Total Income) is taken into account for calculating the tax payable.

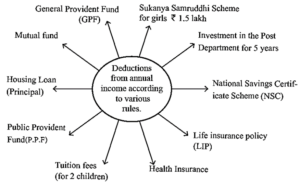

- According to the sections 80C, 80D, 80G, etc. of the Income Tax Act some deductions can be availed from the total annual income. The amount remaining after these deductions are made, is called taxable income. Income tax is levied on this taxable income.

- No tax is levied up to a certain limit of taxable income. This is called the basic exemption limit.

- Farmer's income from agricultural produce is exempt from taxation.

- Under Section 80G of IT Act, donations to Prime Minister's Relief Fund, Chief Minister's Relief Fund and certain other donations to recognized institutions/organisations are exempt from taxation.

- Under section 80D, installments of premium for health insurance are exempt from taxation.

- Generally, the maximum permissible deduction to various kinds of savings under section 80C is ₹ 1,50,000.

Tax rates according to age of taxpayers are fixed in each year's budget. Samples of tables showing tax rates for different income slabs are given below.

Table I : Individuals (up to the age of 60 years)

| Taxable Income slabs (in ₹) | Income Tax | Education cess | Secondary and Higher Education cess |

| Up to 2,50,000 | Nil | Nil | Nil |

| 2,50,001 to 5,00,000 | 5% (On taxable income minus two lakh fifty thousand) | 2% of Income tax | 1% of Income tax |

| 5,00,001 to 10,00,000 | ₹ 12,500 + 20%

(On taxable income minus five lakh) |

2% of Income tax | 1% of Income tax |

| More than 10,00,000 | ₹1,12,500 + 30% (On taxable income minus ten lakh) | 2% of Income tax | 1% of Income tax |

(Surcharge equal to 10% of income tax payable by individuals having an annual income of 50 lakh to one crore rupees and 15% of income tax by individuals having an annual income greater than one crore rupees)

Table II : Senior citizens (Age 60 to 80 years)

| Taxable Income slabs (in ₹) | Income Tax | Education cess | Secondary and Higher Education cess |

| Up to 3,00,000 | Nil | Nil | Nil |

| 3,00,001 to 5,00,000 | 5% (On taxable income minus three lakh fifty thousand) | 2% of Income tax | 1% of Income tax |

| 5,00,001 to 10,00,000 | ₹ 10,000 + 20%

(On taxable income minus five lakh) |

2% of Income tax | 1% of Income tax |

| More than 10,00,000 | ₹1,10,000 + 30% (On taxable income minus ten lakh) | 2% of Income tax | 1% of Income tax |

(Surcharge equal to 10% of income tax payable by individuals having an annual income of 50 lakh to one crore rupees and 15% of income tax by individuals having an annual income greater than one crore rupees)

Table III : Senior citizens (Age above 80 years)

| Taxable Income slabs (in ₹) | Income Tax | Education cess | Secondary and Higher Education cess |

| Up to 5,00,000 | Nil | Nil | Nil |

| 5,00,001 to 10,00,000 | 20% (On taxable income minus five lakh) | 2% of Income tax | 1% of Income tax |

| More than 10,00,000 | ₹1,00,000 + 30% (On taxable income minus ten lakh) | 2% of Income tax | 1% of Income tax |

(Surcharge equal to 10% of income tax payable by individuals having an annual income of 50 lakh to one crore rupees and 15% of income tax by individuals having an annual income greater than one crore rupees) This is applicable to all categories.

Mr Pandit is 75 years of age. Last year his annual income was ₹ 13,25,000. How much is his taxable income? How much tax does he have to pay?

Solution :

The taxable income of Mr Pandit is ₹ 13,25,000.

According to the Table II, he must first pay ₹ 1,10,000 as income tax. In addition on ₹ 3,25,000 (₹ 13,25,000 - ₹ 10,00,000) he has to pay 30% income tax.

₹ 3,25,000 x = ₹ 97,500

∴ his total income tax amounts to ₹ 1,10,000 + ₹ 97,500 = ₹ 2,07,500

Besides this, education cess will be 2% of income tax = ₹ 2,07,500 x = ₹ 4150

A secondary and higher education cess at 1% of income tax = ₹ 2,07,500 x = ₹ 2075

∴ total income tax = Income tax + education cess + secondary and higher education cess = ₹ 2,07,500 + ₹ 4150 + ₹ 2075 = ₹ 2,13,725

Click on link to get PDF from store :

PDF : Class 9th-Mathematics-1-Chapter-6-Financial Planning-Notes

PDF : Class 9th-Mathematics-1-Chapter-6-Financial Planning-Solution

All Chapter Notes-Class-9-Mathematics-1 and 2-(16-PDF)-Rs.68

All Chapter's Solution-Class-9-Mathematics-1 and 2-(16-PDF)-Rs.90

All Chapter's Notes+Solutions-Class-9-Mathematics-1 and 2-(32-PDF)-Rs.140

Main Page : – Maharashtra Board Class 9th-Mathematics – All chapters notes, solutions, videos, test, pdf.

Previous Chapter : Chapter-5-Linear Equations in two variables – Online Notes

Next Chapter : Chapter-7-Statistics – Online Notes